https://vimeo.com/evanparker/review/291368150/995195c9fe

3257 Conkling Place West- Realtor Review!

“I first met Diane Terry many years ago during an open house for our neighbor down the street. We immediately hit it off and I could tell that she was someone who was extremely knowledgeable, not just about real estate, but about life in general. When we were about to start construction on our new house and there was a crisis with my contractor, she was the first person I turned to for advice. We became friends and I saw how she successfully represented a number of my neighbors, friends, and family in their real estate transactions. Her reputation is outstanding. When it was finally time to sell our Queen Anne home, I obviously hired Diane as our agent and was not disappointed. She is the consummate professional. Diane is extremely organized and detail oriented. She gave us a timeline and told us exactly what needed to be done and when. She also referred us to the best stagers, estate sale people, photographers, potted plant people, service providers, etc. to help us prepare our house for sale. I knew that if I followed Diane’s advice and let her do her job, everything would go smoothly. I was impressed by her Instagram “teaser” ad campaign she launched to get people excited about our house even prior to listing. I couldn’t believe how incredible the staging, video with drone shots, and final listing looked. I am a physician and naturally a control freak, but I decided to let the real estate expert take the reins on the sale of our home. She made an extremely stressful time in our lives much more manageable. Thanks to Diane, we sold our house with multiple offers right away and above asking price. I could not recommend her more highly.”

-Diane Chiu, M.D.

Rent or Buy: Either Way You’re Paying A Mortgage!

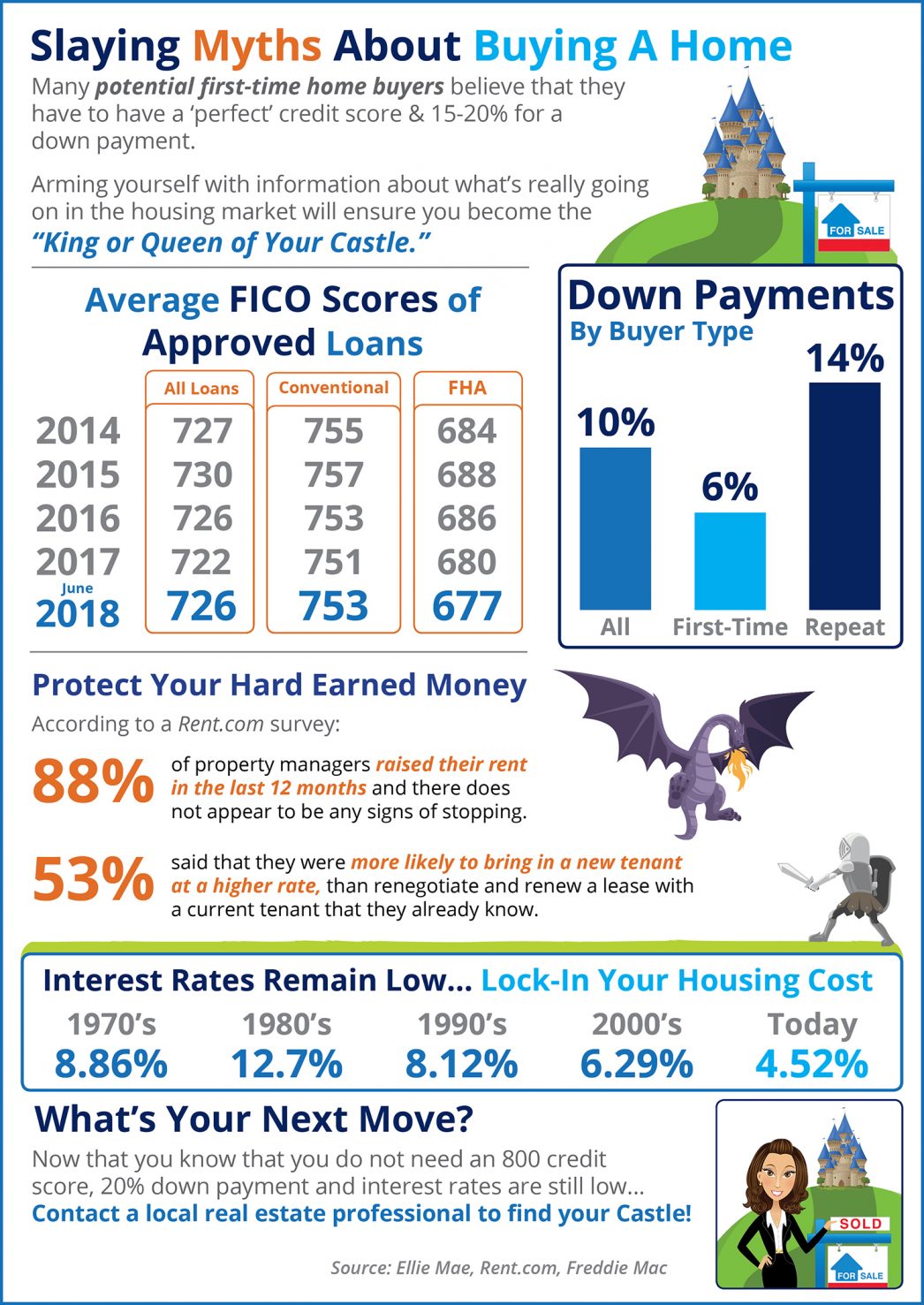

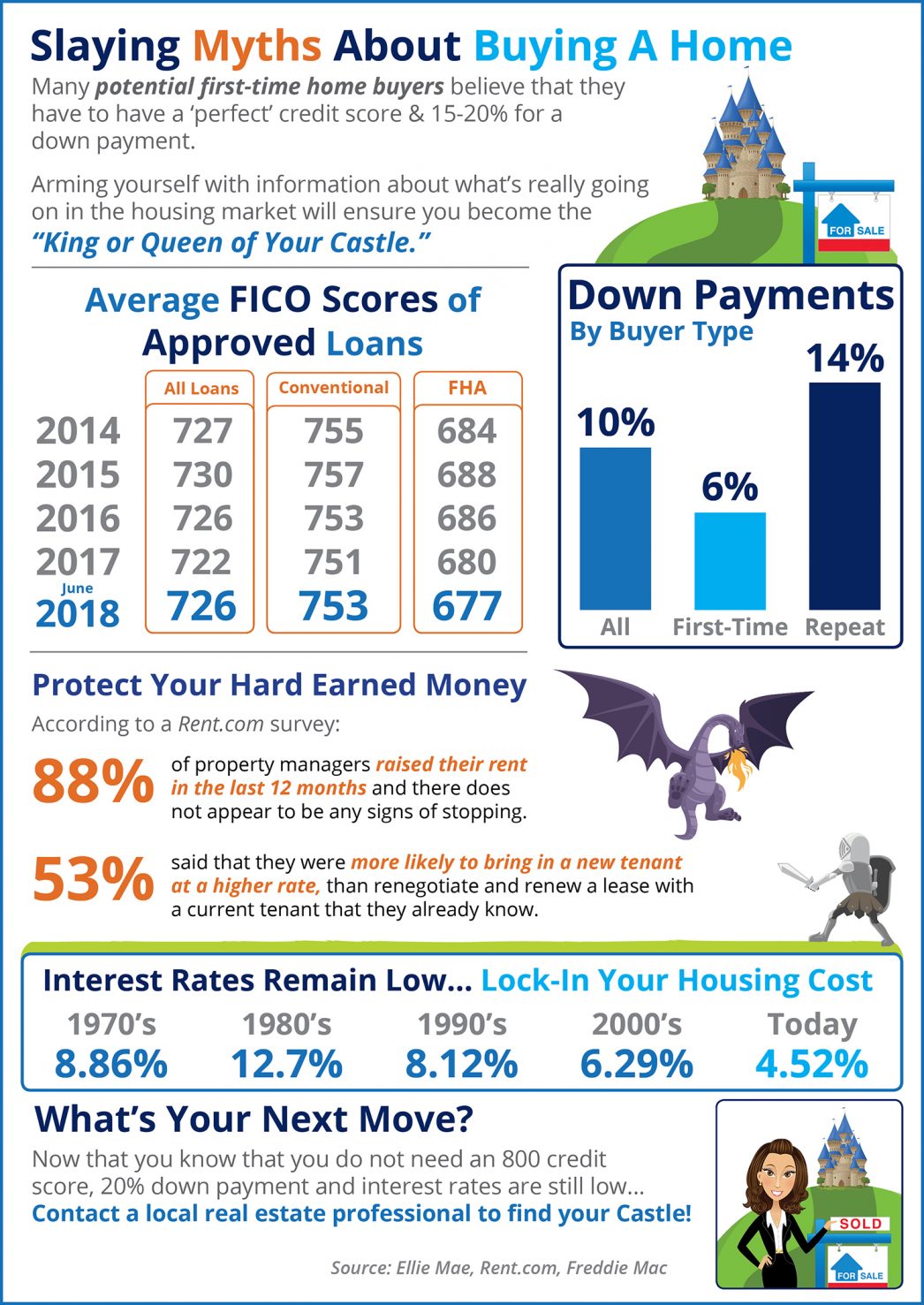

There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize, however, that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As Entrepreneur Magazine, a premier source for small business, explained in their article, “12 Practical Steps to Getting Rich”:

“While renting on a temporary basis isn’t terrible, you should most certainly own the roof over your head if you’re serious about your finances. It won’t make you rich overnight, but by renting, you’re paying someone else’s mortgage. In effect, you’re making someone else rich.”

With home prices rising, many renters are concerned about their house-buying power. Mark Fleming, Chief Economist at First American, explained:

“Over the last three years, renter house-buying power has increased fast enough to keep pace with house price appreciation, so the share of homes that a renter can afford to buy has remained the same since 2015.

Although mortgage rates are expected to rise, they are still low by historic standards, and real household incomes are the highest they have ever been. Assuming this trend continues, our measure of affordability, which takes into account income, interest rates, and house prices, indicates that homeownership is still within reach for renters.”

As an owner, your mortgage payment is a form of ‘forced savings’ which allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee the landlord is the person building that equity.

Interest rates are still at historic lows, making it one of the best times to secure a mortgage and make a move into your dream home. Freddie Mac’s latest report shows that rates across the country were at 4.51% last week.

Bottom Line

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, now may be the time to buy.

Housing Market: Another Gigantic Difference Between 2008 and 2018

Some are attempting to compare the current housing market to the market leading up to the “boom and bust” that we experienced a decade ago. They look at price appreciation and conclude that we are on a similar trajectory, speeding toward another housing crisis.

However, there is a major difference between the two markets. Last decade, while demand was being artificially created by extremely loose lending standards, a tremendous amount of inventory was coming to the market to satisfy that demand. Below is a graph of the inventory of homes available for sale leading up to the 2008 crash.

A normal market should have approximately 6 months supply of housing inventory. As we can see, that number jumped to over 11 months supply leading up to the housing crisis. When questionable mortgage practices ceased, and demand dried up, there was a glut of inventory on the market which caused prices to drop as there was too much supply and not enough demand.

Today is radically different!

There are those who believe that low mortgage rates have created an artificial demand in the current market. They fear that if mortgage rates continue to rise, some of the current demand will dry up (which is a possibility).

However, if we look at supply again, we can see that the current supply of homes is well below the norm of 6 months.

Bottom Line

We will not have a glut of inventory like we did back in 2008 and home values won’t come tumbling down. Instead, if demand weakens, we will return to a normal market (approximately a 6-month supply) with historic levels of appreciation (3.6% annually).

Happy Hour for Good 2018

I am elated to announce that we raised a total of $60,000 at the Lake Union Rotary Happy Hour for Good dedicated to YouthCare that I sponsored last week!

These Happy Hours are always a very collaborative evening and I could not have pulled it off without the help of my Happy Hour Heroes or members of the Rotary Club that I count on for set up and take down, desserts and bar tending. Fremont Brewery donated a keg to us this year. Mark Ryan Winery via McCarthy Schiering and Molly’s Creations gave us a generous discounts. The wonderful Shed Boys provided us music again this year and had us in a generous and giving mood. I have been passionate about supporting YouthCare for decades. Youth Homelessness is an issue we can actually solve. Providing hope and help their first day of homelessness is the answer in my book. It is much less costly to redirect and help then vs adult homelessness. It just makes sense. I was tremendously blessed to have so many people step up this year in their giving. My colleagues at Windermere Midtown both from our Foundation funds and individually were humbling. We had several anonymous donors who provided the match pool this year. I was a bit overcome at the final tally. Thank you to everyone!

Supply & Demand Will Determine Future Home Values

Will home values continue to appreciate throughout 2018? The answer is simple: YES! – as long as there are more purchasers in the market than there are available homes for them to buy. This is known as the theory of “supply and demand,” which is defined as:

“The amount of a commodity, product, or service available and the desire of buyers for it, considered as factors regulating its price.”

When demand exceeds supply, prices go up. Every month this year, demand (buyer traffic) has increased as compared to last year and for the first five months of 2018, supply (the number of available listings) had decreased as compared to last year. However, a recent report by the National Association of Realtors (NAR) revealed the first year-over-year increase in supply in three years.

Here are the numbers for supply and demand as compared to last year since the beginning of 2018:

The increase in the June numbers doesn’t mean that prices won’t continue to appreciate. In that same report, Lawrence Yun, NAR’s Chief Economist, explained:

“It’s important to note that despite the modest year-over-year rise in inventory, the current level is far from what’s needed to satisfy demand levels.

Furthermore, it remains to be seen if this modest increase will stick, given the fact that the robust economy is bringing more interested buyers into the market, and new home construction is failing to keep up.”

Bottom Line

The reason home prices are still rising is that there are many purchasers looking to buy but very few homeowners ready to sell. This imbalance is the reason prices will remain on the uptick.

5 Reasons to Hire a Real Estate Professional Before Entering the Market!

Whether you are buying or selling a home, it can be quite the adventure. In this world of instant gratification and internet searches, many sellers think that they can ‘For Sale by Owner’ or ‘FSBO,’ but it’s not as easy as it may seem. That’s why you need an experienced real estate professional to guide you on the path to achieving your ultimate goal!

The 5 reasons you need a real estate professional in your corner haven’t changed but have rather been strengthened by the projections of higher mortgage interest rates and home prices as the market continues to pick up steam.

1. What do you do with all this paperwork?

Each state has different regulations regarding the contracts required for a successful sale, and these regulations are constantly changing. A true real estate professional is an expert in his or her market and can guide you through the stacks of paperwork necessary to make your dream a reality.

2. So you found your dream house, now what?

There are over 230 possible steps that need to take place during every successful real estate transaction. Don’t you want someone who has been there before, someone who knows what these actions are, to ensure you achieve your dream?

3. Are you a good negotiator?

So maybe you’re not convinced that you need an agent to sell your home. After looking at the list of parties that you will need to be prepared to negotiate with, you’ll soon realize the value in selecting a real estate professional. From the buyers (who want the best deals possible), to the home inspection companies, all the way to the appraisers, there are at least 11 different people who you will need to be knowledgeable of, and answer to, during the process.

4. What is the home you’re buying/selling really worth?

It is important for your home to be priced correctly from the start in order to attract the right buyers and shorten the amount of time that it’s on the market. You need someone who is not emotionally connected to your home to give you its true value. According to a recent article by the National Association of Realtors, FSBOs achieve prices significantly lower than the prices of similar properties sold by real estate agents:

“FSBOs earn an average of $60,000 to $90,000 less on the sale of their home than sellers who work with a real estate agent.”

Get the most out of your transaction by hiring a professional!

5. Do you know what’s really going on in the market?

There is so much information out there on the news and on the internet about home sales, prices, and mortgage rates; how do you know what’s going on specifically in your area? Who do you turn to in order to competitively and correctly price your home at the beginning of the selling process? How do you know what to offer on your dream home without paying too much, or offending the seller with a lowball offer?

Dave Ramsey, the financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Hiring an agent who has his or her finger on the pulse of the market will make your buying or selling experience an educated one. You need someone who is going to tell you the truth, not just what they think you want to hear.

Bottom Line

You wouldn’t replace the engine in your car without a trusted mechanic, so why would you make one of the most important financial decisions of your life without hiring a real estate professional?

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link