All in, for Community

The #1 Reason To Sell Your House Today

Almost every industry is currently struggling with supply chain disruptions. This also applies to the current U.S. housing market, where buyer demand far exceeds housing supply.

Purchaser demand is very strong right now. The National Association of Realtors (NAR) just released their latest Existing Home Sales Report which reveals that sales surged in January. Existing home sales rose to a seasonally adjusted annual rate of 6.5 million – an increase of 6.7% from the prior month, with sales up in all regions. However, there’s one big challenge.

Inventory Is at an All-Time Low

Because purchaser demand is so high, the market is running out of available homes for sale. The above-mentioned report states that the current months’ supply of inventory of homes for sale has fallen to 1.6 months. This prompts Lawrence Yun, Chief Economist at NAR, to say:

“The inventory of homes on the market remains woefully depleted, and in fact is currently at an all-time low.”

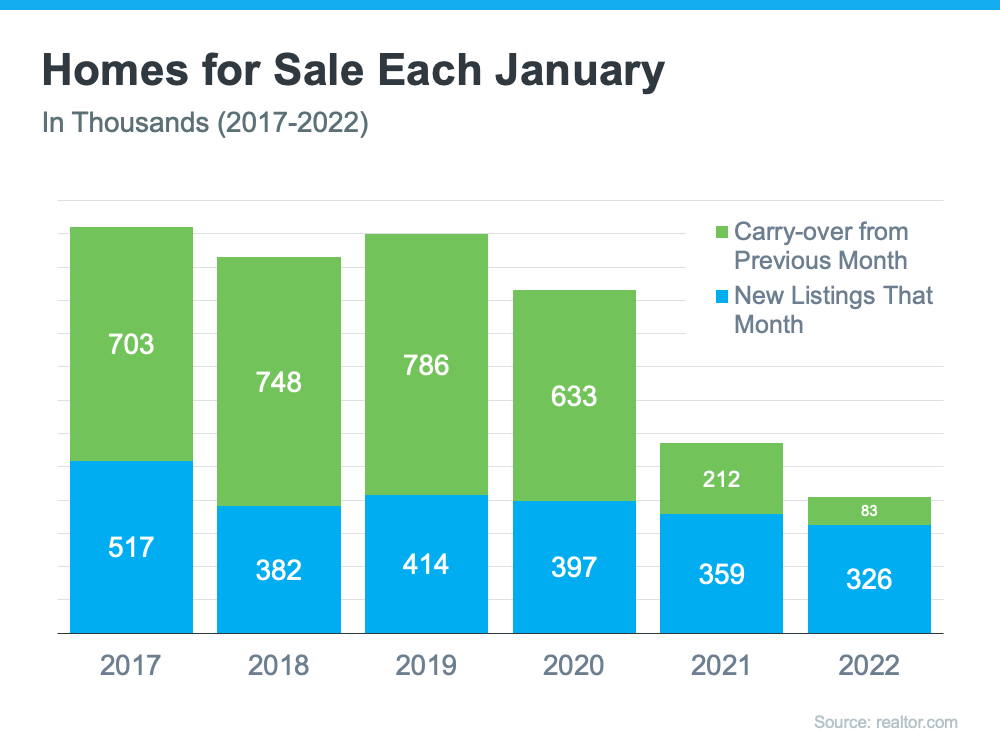

Earlier this month, realtor.com released their inventory data for January. It helps confirm this point. Here’s a graph comparing inventory levels for January over the last six years:

As the graph shows, new listings coming on the market have decreased over the last four years (shown in blue in the graph). The graph also reveals that carry-over inventory has plummeted in recent years. This is because listings are now sold so quickly, they don’t stay on the market long enough to carry over month-to-month (shown in green in the graph). In other words, homes are not staying on the market for months as they had prior to the pandemic. In the report mentioned above, NAR reveals that:

“Seventy-nine percent of homes sold in January 2022 were on the market for less than a month.”

Odeta Kushi, Deputy Chief Economist at First American, explains it like this:

“A higher velocity of sales (lower [Days on Market]) helps to explain a housing market characterized by both higher sales & lower inventory. Many resale transactions are happening so quickly that they ‘flow’ in & then out of the ‘stock’ between the fixed monthly measurement of inventory.”

What Does This Mean for Sellers?

Anyone thinking of putting their home on the market shouldn’t wait. A seller will always negotiate the best deal when demand is high and supply is limited. That’s exactly the situation in the real estate market today.

Later this year, inventory (and by extension, your competition) will increase as many homeowners are waiting to put their homes on the market in the spring and early summer.

In addition, Len Kiefer, Deputy Chief Economist at Freddie Mac, says:

“Housing starts start off 2022 strong, just edging out 2021 for most in January since 2006.”

As these newly built homes are completed, they will also become competition for your house. This gives you a tremendous opportunity right now. Don’t wait for that increase in competition in your area. If you want to sell in 2022 and are ready to start the process, today is the day to list your house.

Bottom Line

If you’re ready to sell, let’s connect to get your house on the market while today’s inventory situation is in your favor.

Fundraiser for the Sam Smith Homeownership Fund

Sam Smith Homeownership Fund Resources

As a part of Windermere’s ongoing commitment to making access to homeownership more equitable, Windermere has partnered with HomeSight, an organization that provides financing opportunities to low-to-moderate-income home buyers who have historically been underserved by traditional lenders.

Through donations from the Windermere Foundation, the new Sam Smith “Hi Neighbor” homeownership fund aims to help reduce the barriers to homeownership by funding loan products for Black/African American first-time home buyers in Western Washington.

Who is Sam Smith and who does the fund help?

Named for legendary Washington State Legislator Sam Smith, who passed the state’s Open Housing Law barring discrimination based on race and religion in 1967, the Sam Smith fund helps Black/African Americans achieve their dream of homeownership. Building on Sam’s legacy, the fund provides deferred, low-interest loans to bridge the affordability gap for low-to-moderate-income Black/African Americans whose homeownership rates have lagged far behind the rest of the population in Washington State, and for whom few resources are available.

If you are interested in donating to the Sam Smith Homeownership Fund, please follow the link HERE !

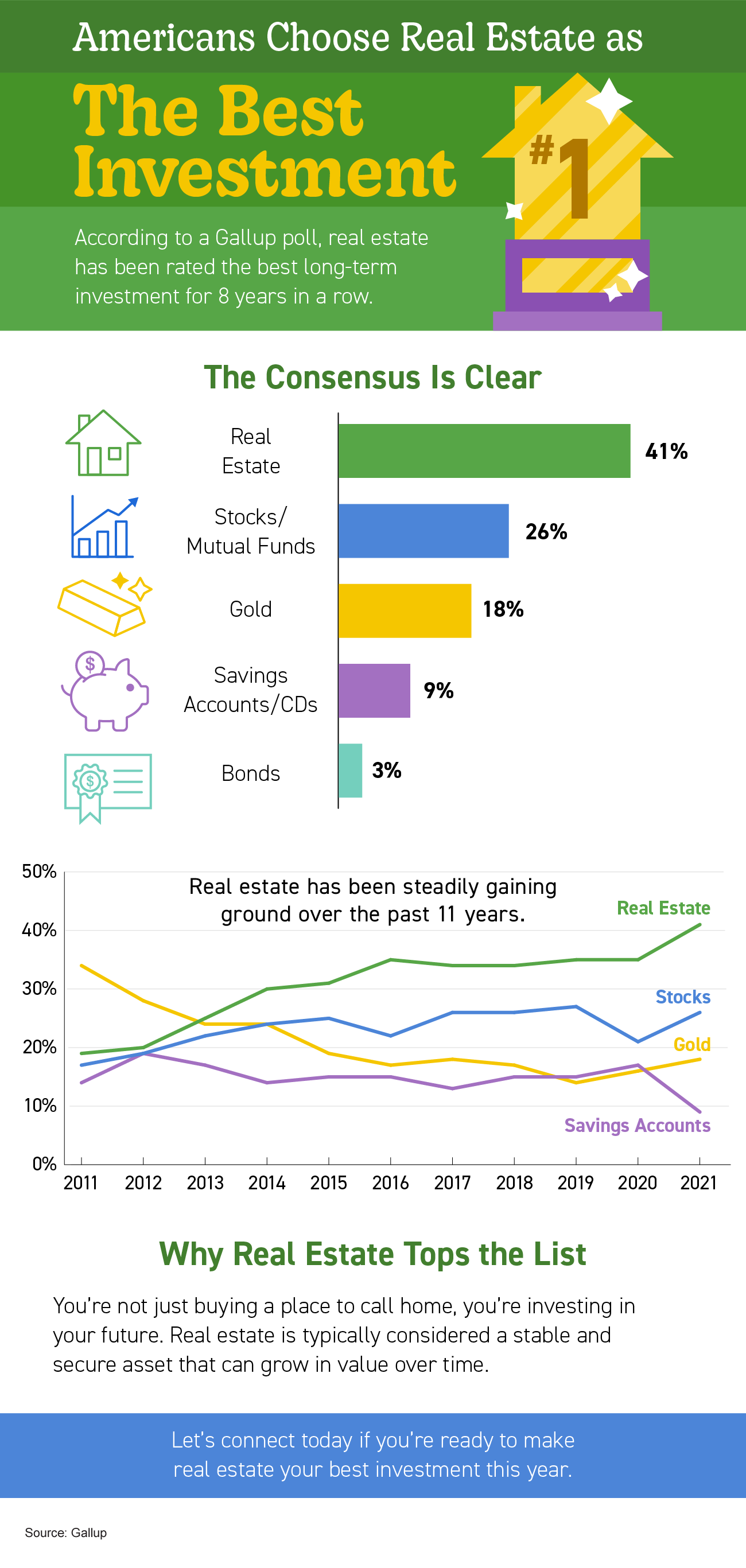

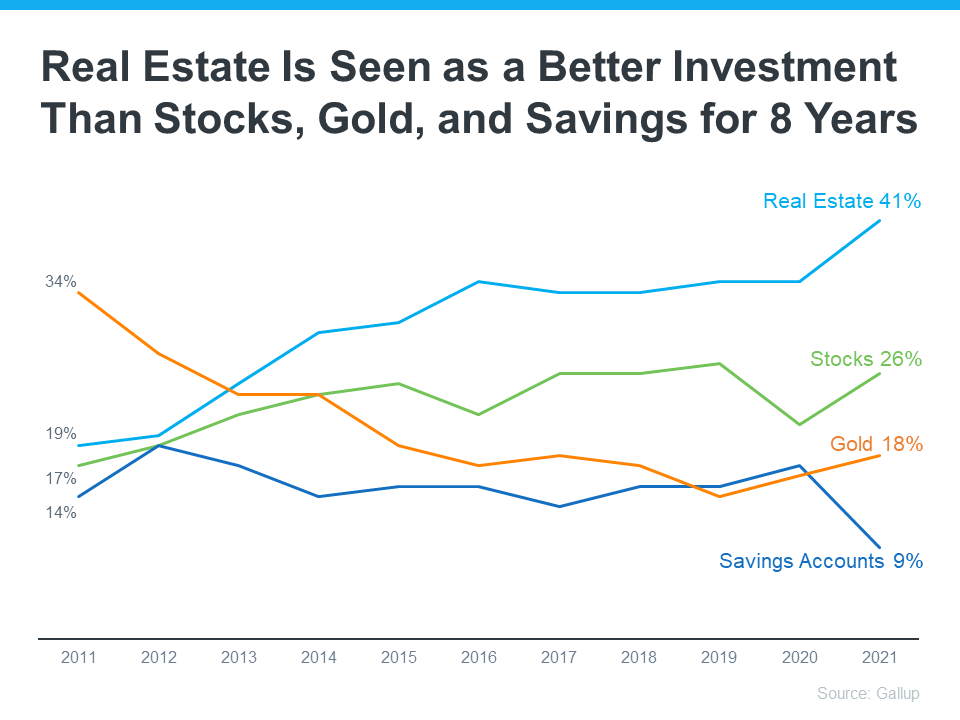

Real Estate Voted the Best Investment Eight Years in a Row

In an annual Gallup poll, Americans chose real estate as the best long-term investment. And it’s not the first time it’s topped the list, either. Real estate has been on a winning streak for the past eight years, consistently gaining traction as the best long-term investment (see graph below):

If you’re thinking about purchasing a home this year, this poll should reassure you. Even when inflation is rising like it is today, Americans agree an investment like real estate truly shines.

If you’re thinking about purchasing a home this year, this poll should reassure you. Even when inflation is rising like it is today, Americans agree an investment like real estate truly shines.

Why Is Real Estate a Great Investment During Times of High Inflation?

With inflation reaching its highest level in 40 years, it’s more important than ever to understand the financial benefits of homeownership. Rising inflation means prices are increasing across the board. That includes goods, services, housing costs, and more. But when you purchase your home, you lock in your monthly housing payments, effectively shielding yourself from increasing housing payments. James Royal, Senior Wealth Management Reporter at Bankrate, explains it like this:

“A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. Sure, property taxes will rise and other expenses may creep up, but your monthly housing payment remains the same.”

If you’re a renter, you don’t have that same benefit, and you aren’t protected from increases in your housing costs, especially rising rents.

History Shows During Inflationary Periods, Home Prices Rise as Well

As a homeowner, your house is an asset that typically increases in value over time, even during inflation. That‘s because, as prices rise, the value of your home does, too. And that makes buying a home a great hedge during periods of high inflation. Natalie Campisi, Advisor Staff for Forbes, notes:

“Tangible assets like real estate get more valuable over time, which makes buying a home a good way to spend your money during inflationary times.”

Bottom Line

Housing truly is a strong investment, especially when inflation is high. When you lock in a mortgage payment, you’re shielded from housing cost increases, and you own an asset that typically gains value with time. If you want to better understand how buying a home could be a great investment for you, let’s connect today.

Are You Ready To Fall in Love with Homeownership?

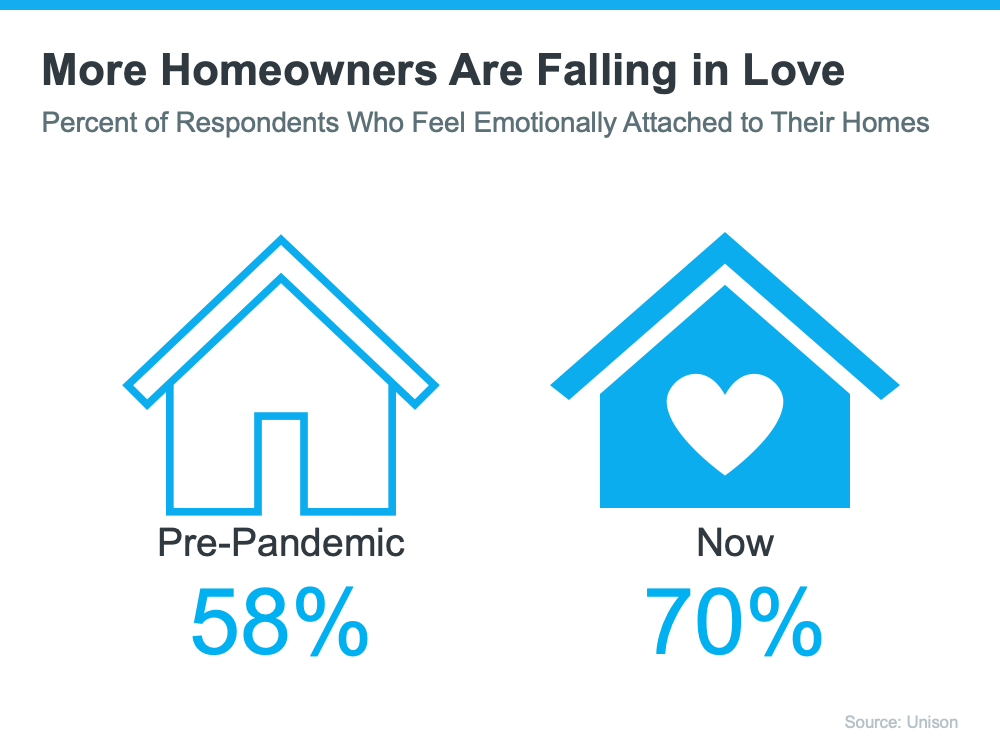

Financial benefits are always a key aspect of homeownership, but it’s also important to understand that the nonfinancial and personal benefits are why so many people genuinely fall in love with their homes. When you own your home, you likely feel a sense of emotional attachment because of the comfort it provides, but also because it’s a space that’s truly yours.

Over the past two years, we’ve learned to love our homes even more as we’ve stayed home more than ever due to the ongoing pandemic. As a result, the personal and emotional benefits our homes provide have become even more important to us.

As the most recent State of the American Homeowner from Unison puts it:

“Despite the upheaval and uncertainty of the past year, one thing has stayed the same: the home continues to be of the utmost importance and a place of security and comfort.”

When the health crisis began, the world around us changed almost overnight, and our homes were redefined. Our needs shifted, and our shelters became a place that protected us on a whole new level. The same study from Unison notes:

- 91% of homeowners say they feel secure, stable, or successful owning a home

- 64% of American homeowners say living through a pandemic has made their home more important to them than ever

- 83% of homeowners say their home has kept them safe during the COVID-19 pandemic

It’s no surprise this study also reveals that homeowners now love their homes even more as our emotional attachments to them have grown:

That sense of emotional connection genuinely reaches far beyond the financial aspect of homeownership. Because they’re our shelters – ones that we can genuinely call our own. Our homes touch our hearts and can also positively impact our mental health.

As JD Esajian, President of CT Homes, LLC, says:

“Aside from the financial factors, there are several social benefits of homeownership and stable housing to consider. It has long been thought that buying a home contributes to a sense of accomplishment. Still, most individuals fail to realize that homeownership can benefit your mental health and the community around you.”

Whether you’re thinking of buying your first home, moving up to your dream home, or downsizing to something that better fits your changing lifestyle, take a moment to reflect on what Mark Fleming, Chief Economist at First American, notes:

“Buying a home is not just a financial decision. It’s also a lifestyle decision.”

Bottom Line

There are so many reasons to fall head over heels for homeownership. Your home will provide a place to customize and call your own, in addition to stability and security. If you’re ready to fall in love with homeownership, let’s connect so you can get started on your homebuying journey today.

American Lifestyle – February 2022

“We are officially in the second month of 2022 – can you believe it? Hopefully, you’re still riding the wave of new year excitement, but, if not, this issue of American Lifestyle is here to re-energize your outlook and help you feel enthusiastic about the months ahead.” Follow the link HERE to read the full American Lifestyle magazine for February 2022!

The Next Generation of Homebuyers Is Here

Many members of Generation Z (Gen Z) are aging into adulthood and deciding whether to rent or buy a home. If you find yourself in this group, it’s important to understand you’re never too young to start thinking about homeownership. The sooner you start planning, the sooner you can move on from renting.

As you set off on your journey and plan your next move, here are a few reasons to think about homebuying this year.

The Reasons Gen Z Want To Become Homeowners

While the majority of Gen Z haven’t entered the housing market yet, a large portion plan to according to a realtor.com report. The report found that 72% of Gen Z would rather purchase a home than rent long-term. As George Ratiu, Manager of Economic Research for realtor.com, says:

“With nearly three-quarters of those surveyed preferring to buy versus renting long-term, the housing industry should be prepared for millions of Gen Z buyers to bring a new wave of demand along a similar stage-of-life timeline as the millennial generation before them.”

But why do so many members of Gen Z value homeownership? According to the latest Home Buyers and Sellers Generational Trends Report from the National Association of Realtors (NAR), young homebuyers – more than any other age group – want to become homeowners because they want to have a place of their very own.

That may be because one of the biggest benefits of homeownership is having a place that you can truly make your own by customizing it to your style and personality. Whether that’s the décor, painting, or renovations, when you own your home, you don’t have to limit yourself to what your lease and landlord will allow.

Not to mention, owning a home provides much greater long-term stability and security than renting. When you own a home, there’s also protection from steadily rising rental costs because your monthly mortgage payment is locked in for the length of your loan (typically 15 to 30 years).

Work with a Real Estate Professional To Achieve Your Goals

Whether you’re just getting started on your homebuying journey, you want to learn more about the process, or you’re fully committed to buying your first home this year, it’s especially important to connect with a trusted real estate advisor soon, as you won’t be the only first-time buyer in the market. According to a recent survey from realtor.com, a majority of first-time buyers surveyed are looking to purchase a home in 2022. As the survey notes:

“First-time home buyers retain their optimism despite a challenging housing market in the past year. Hoping to achieve their goal of homeownership and provide a comfortable space for their families, young buyers are setting out to learn what they can about the market and setting their list of priorities for their home purchase.”

That means you’ll likely face strong competition from other first-time buyers. One way to get a leg-up on that competition is to work with a real estate professional to make sure you have the support you need to make an informed and confident decision.

Bottom Line

If you’re planning your next move, you’re not alone. Just know it’s never too early to consider the benefits of homeownership over renting. To learn more, let’s connect today so you have a trusted professional on your side to help you explore your options.

Americans Choose Real Estate as the Best Investment

Some Highlights

- According to a Gallup poll, real estate has been rated the best long-term investment for eight years in a row.

- Real estate tops the list because you’re not just buying a place to call home – you’re investing in your future. Real estate is typically considered a stable and secure asset that can grow in value over time.

- Let’s connect today if you’re ready to make real estate your best investment this year.

Buyers Want To Know: Why Is Housing Supply Still So Low?

One key question that’s top of mind for homebuyers this year is: why is it so hard to find a house to buy? The truth is, we’re in the ultimate sellers’ market, so real estate is ultra-competitive for buyers right now. The number of buyers searching for a home greatly outweighs how many homes are available for sale.

While low inventory in the housing market isn’t new, it’s a challenge that continues to grow over time. Here’s a look at two reasons why today’s housing supply is low and what that means for you.

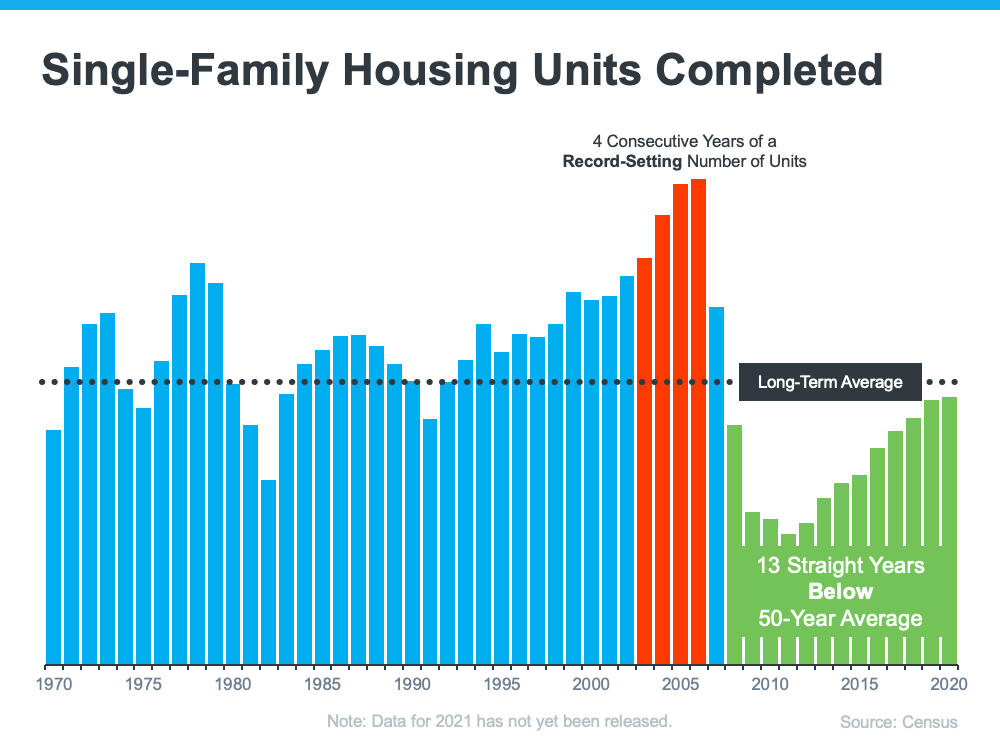

1. New Home Construction Fell Behind for Several Years

The graph below shows new home construction for single-family homes over the past five decades, including the long-term average for housing units completed. Builders exceeded that average during the housing bubble (shown in red on the graph). The result was an oversupply of homes on the market, so home values declined. That was one of the factors that led to the housing crash back in 2008.

Since then, the level of new home construction has fallen off. For the last 13 straight years, builders haven’t been able to construct enough homes to meet the historical average (as illustrated in green on the graph). That underbuilding left us with a multi-year inventory deficit going into the pandemic.

2. The Pandemic’s Impact on the Housing Market

Then, when the pandemic hit, it fueled a renewed appreciation and focus on the meaning of home. Having a safe space to live, work, school, and exercise became even more important for Americans throughout the country. So, as mortgage rates dropped to at or below 3%, buyers eagerly entered the market looking to capitalize on those low rates to secure a home that would fulfill their changing needs. At the same time, sellers hesitated to put their houses on the market as concerns about the pandemic mounted.

The result? The number of homes available for sale dropped even further. A recent article from realtor.com explains:

“Last month, the number of home listings dropped 26.8% compared with the same time a year earlier. This meant there were about 177,000 fewer homes listed in what’s already typically a slower month due to the holidays and colder weather. . . .”

What Does All of This Mean for You?

For a buyer, low inventory can be a challenge. You want to find the home of your dreams, and you don’t want to settle. But what if there just aren’t that many homes to choose from?

There is some good news. Experts are projecting more homes will soon become available thanks to sellers re-entering the market. Danielle Hale, Chief Economist at realtor.com, shares this hope, but offers perspective:

“We expect that we’ll start to see a turnaround and inventory will stabilize and start to go up a little bit in 2022. . . . But that means we’re looking at inventory levels of roughly half of what we saw before the pandemic. For buyers, the market is likely to continue to move fast. If you see a home you like, you want to jump on it right away.”

Basically, inventory is still low, even though more homes are coming. But you shouldn’t put your plans on hold because you’re waiting for those additional houses to hit the market. Instead, stick with your search and persevere through today’s low inventory. You can find your next home if you’re patient and focused.

Remember your goals and why finding a home is so important. Those things should be the driving force behind your search. Share them with your agent and be clear about your priorities. Your trusted advisor is your greatest support as you navigate today’s low housing supply to find the home of your dreams.

Bottom Line

If you’re planning to buy this year, the key to success will be patience given today’s low inventory. Let’s connect to discuss what’s happening in our area, what homes are available, and why it’s still worthwhile to prioritize your home search today.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link